Mastercard Choose Well

Services

Product Design

UX Design

User Research

Date

August 2021

Scroll

Research

From the outset of this project, I pushed for the opportunity to conduct preliminary research into the user pain points in the insurance selection and enrollment process. I conducted informal interviews with

employees at different career and life stages including both those familiar and unfamiliar with the Choose Well tool. I also analyzed the solutions utilized by other large companies.

Audience

- New Grads — These users are completely unfamiliar with the insurance enrollment process; they need a tool that provides keyword definitions, includes step-by-step instructions, and helps them to estimate their healthcare needs

- New Hires & Fresh Circumstances — These users are familiar with insurance enrollment and have some sense of their yearly healthcare spend but aren't familiar with Mastercard's specific offerings; this also includes employees who have recently experienced a lifestyle change such as the birth of a child or a change in spousal employment.

- Repeat Enrollers — These users have enrolled in Mastercard insurance before and are primarily concerned with re-enrolling in the most efficient way possible; they only need to be alerted of any changes to their coverage and to re-enroll in any plans which do not automatically renew

Pain Points

During these interviews, I also noted common pain points among Mastercard employees. Despite Mastercard offering three major sources of insurance information, the HR site, ALEX the automated benefits counselor, and Choose Well, generally, new employees lacked awareness of Mastercard's insurance offerings and reported "guessing" what plans would be appropriate. Contrastingly,

longtime employees reported skipping through the enrollment process and expressed irritation that the available tools were too informative and thus inconvenient. Because experiences differed so completely between users, it quickly became clear that a personalized flexible solution would be necessary to suit the needs of all employees.

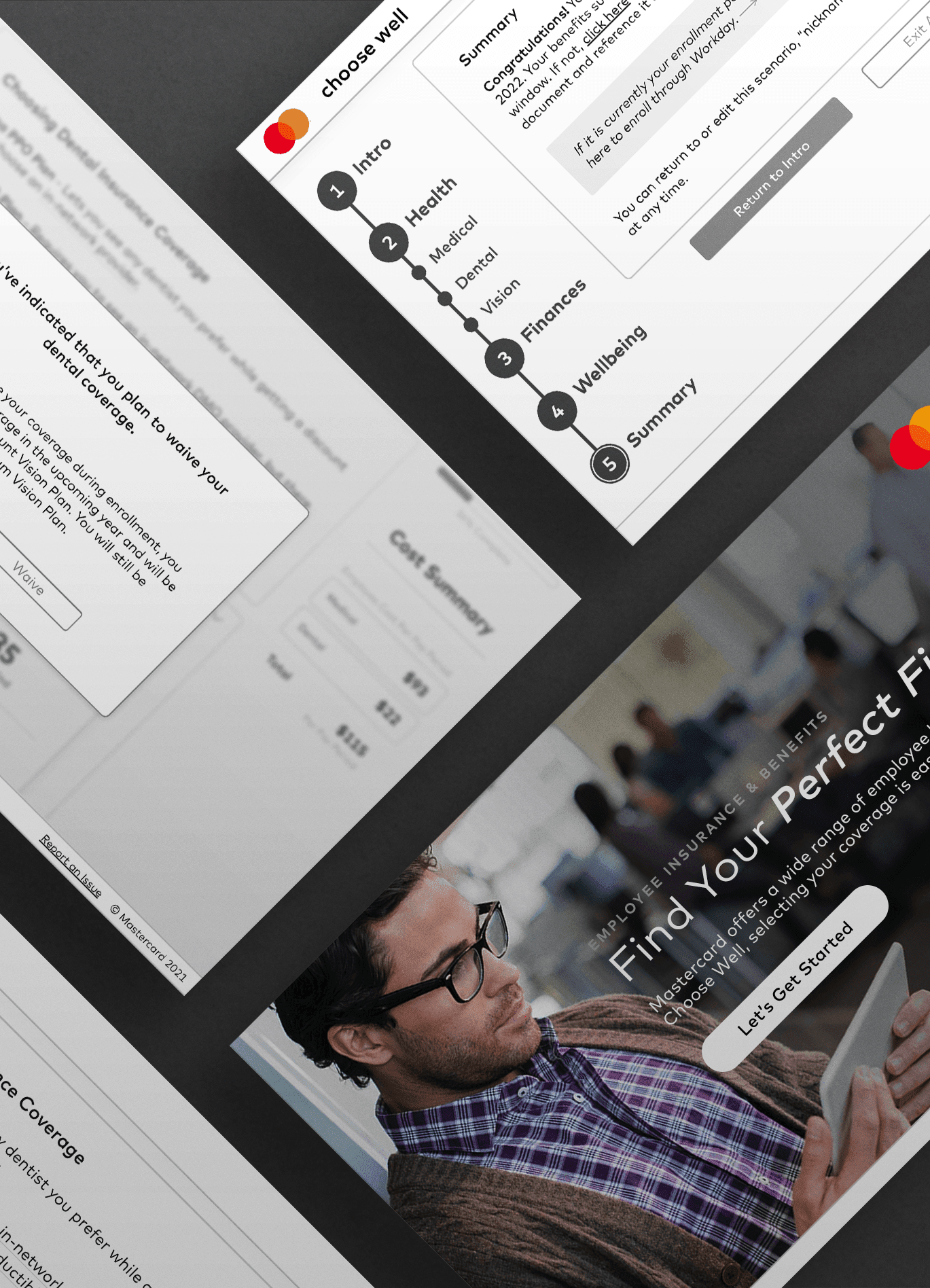

PROOF OF CONCEPT & REVIEW

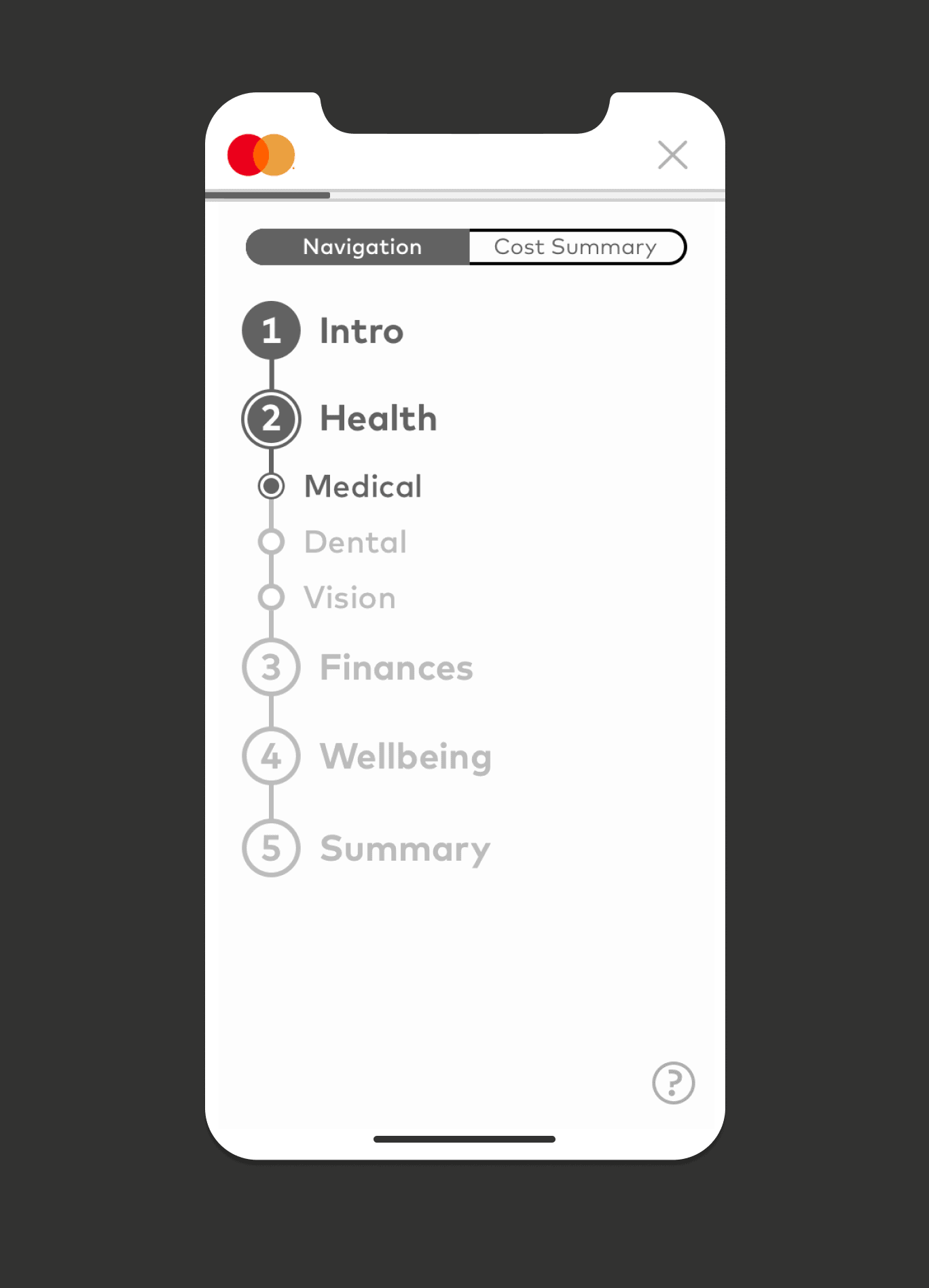

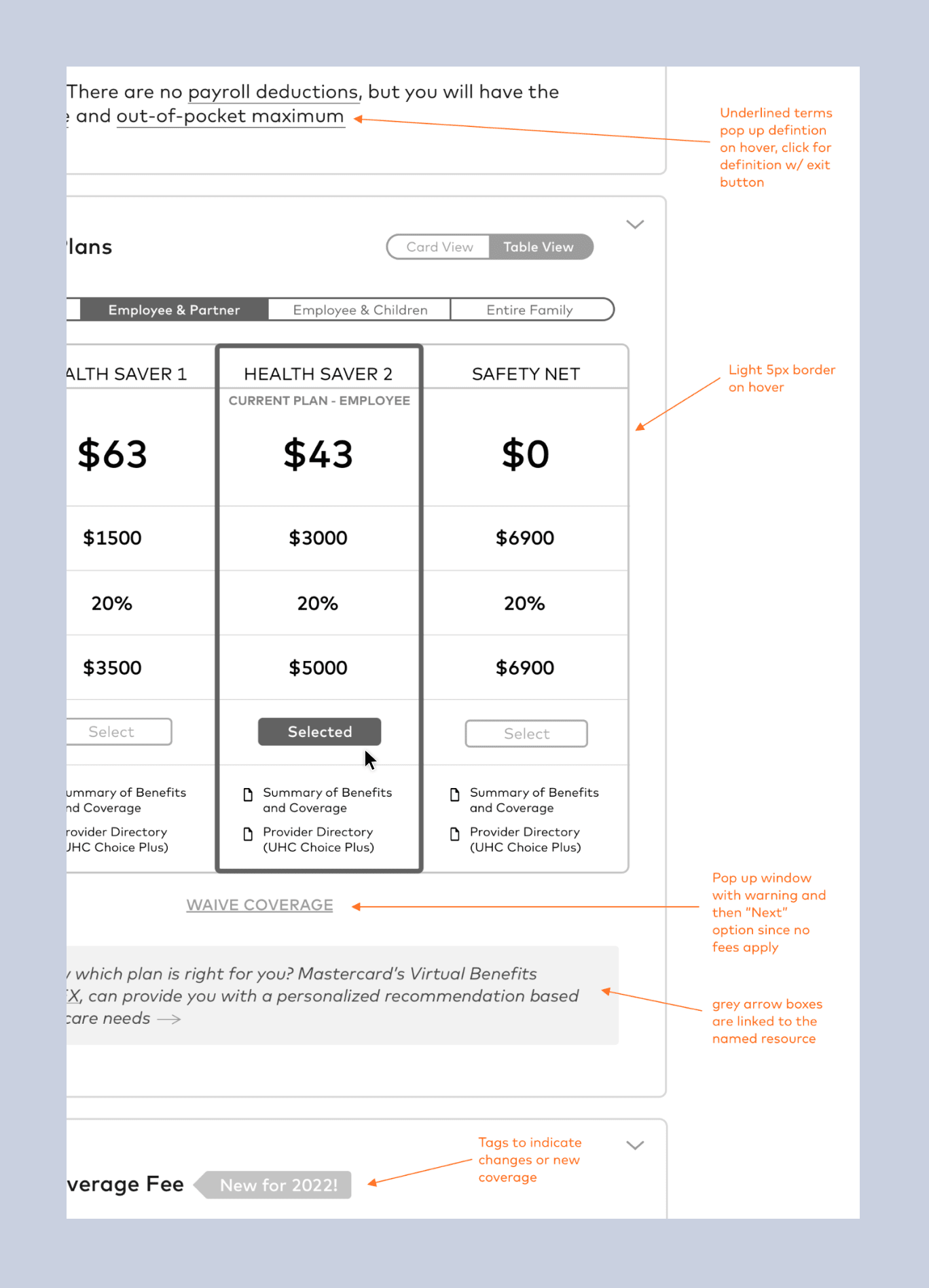

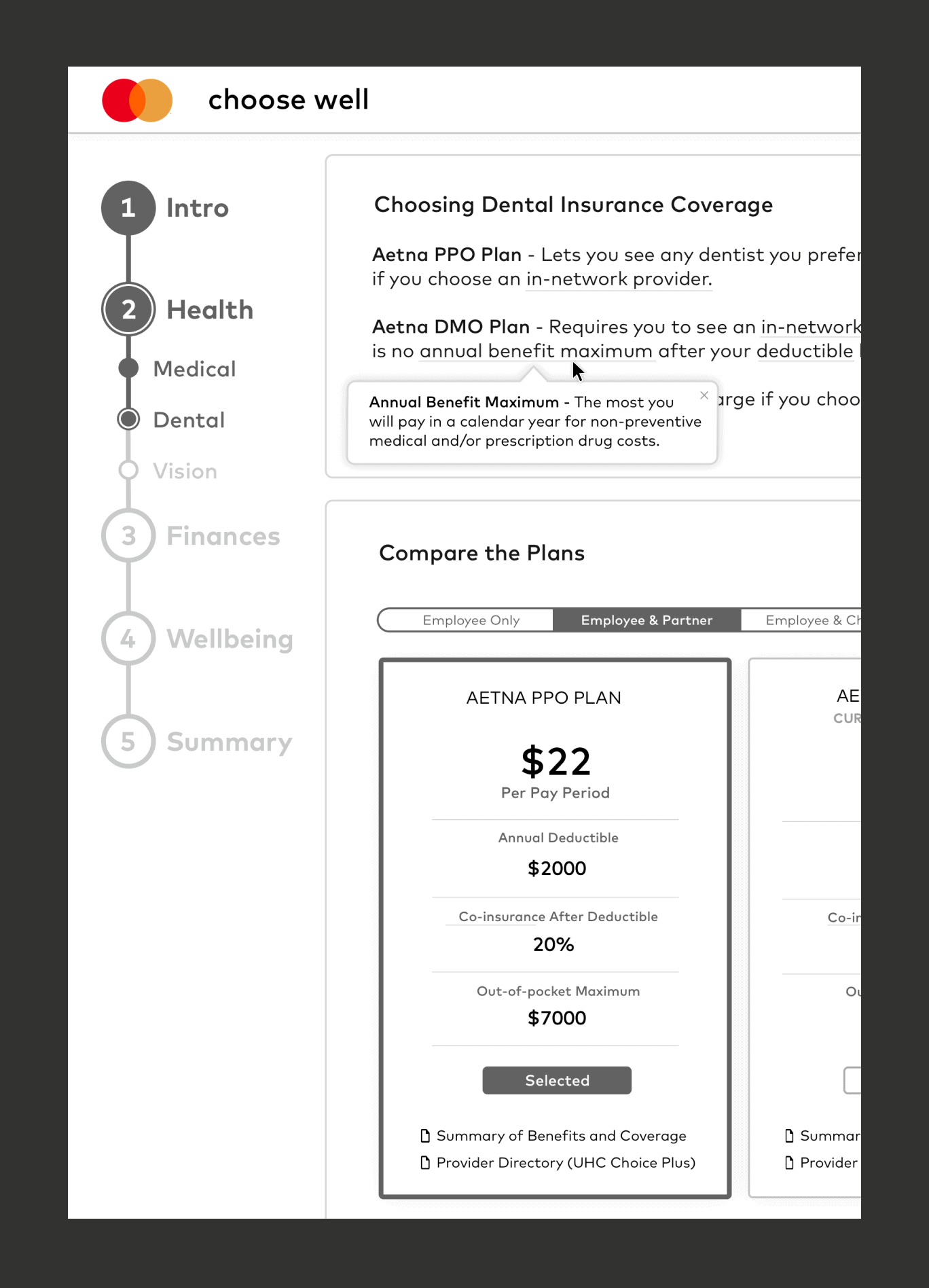

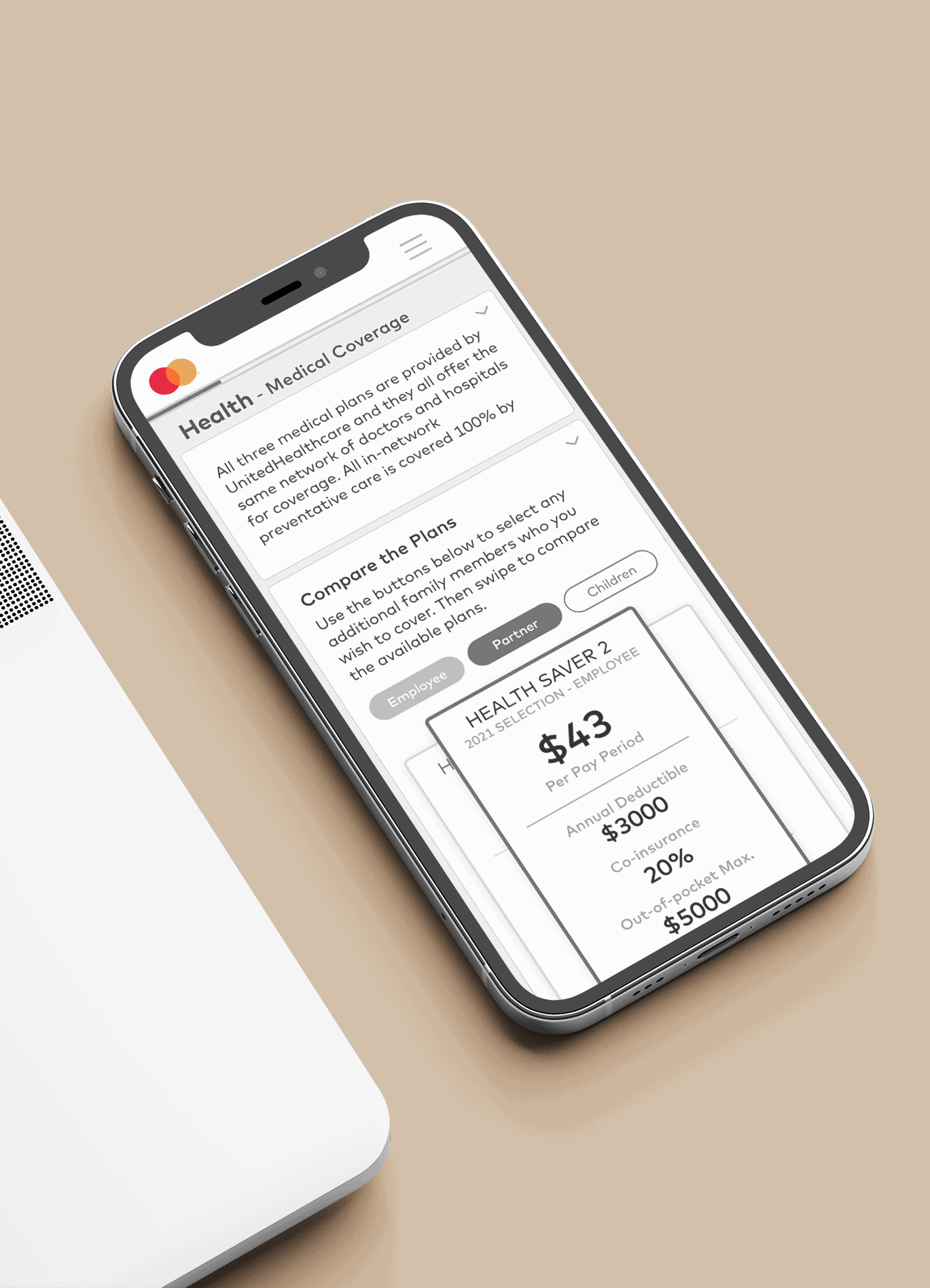

Over several weeks, I developed a new tool under the name Choose Well and produced five different low-fidelity prototypes. In addition to the desktop site, I adapted the application for mobile use to make the program more accessible. The inconvenience was repeatedly cited as a major flaw in the existing solution and this expansion will allow employees to quickly update their insurance plans while commuting or checking email. After evaluating my solutions and sharing them with my interviewees, I selected and combined two of my initial

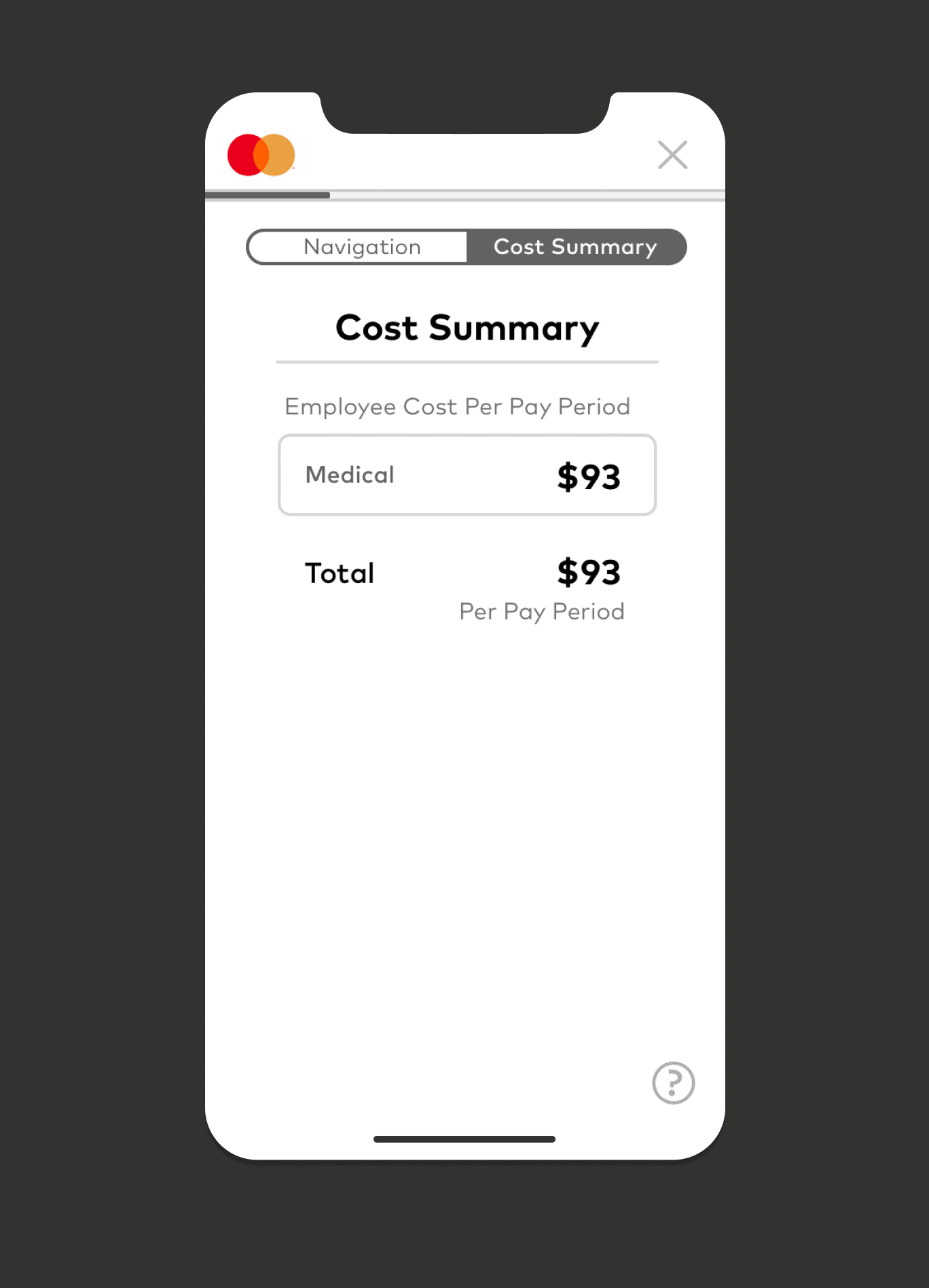

ideas, developing a single prototype with a card layout and numbered chronological steps. I conducted several rounds of review and revision of my prototype, each time speaking with professional UX designers belonging to each of the user categories to get comprehensive feedback from multiple perspectives. Through this feedback, I added several features including a real-time per-month cost summary to help employees track the cost of their planned coverage and the ability to create, save, and compare multiple insurance scenarios.

Implementation

Once I was confident in my design's functionality, I expanded my low-fidelity prototype to demonstrate each of the new features I wished to highlight. I formally presented the complete design to my supervisor and my team as well as the product owners of the existing insurance tools. These wireframes earned all-around approval and are displayed here along with the interactive prototype below.

- Personalized Experience - a new facet to the application that connects insurance selections in Choose Well to individual employee accounts

- Scenario & Plan Comparisons - an addition to the personalized experience that allows employees to save multiple benefits scenarios to their accounts

- Real-time Cost Summary - a new feature that allows employees to track the monthly cost of their selections as they go

- Highlighted Updates - a simple addition that draws attention to changes in coverage for returning users

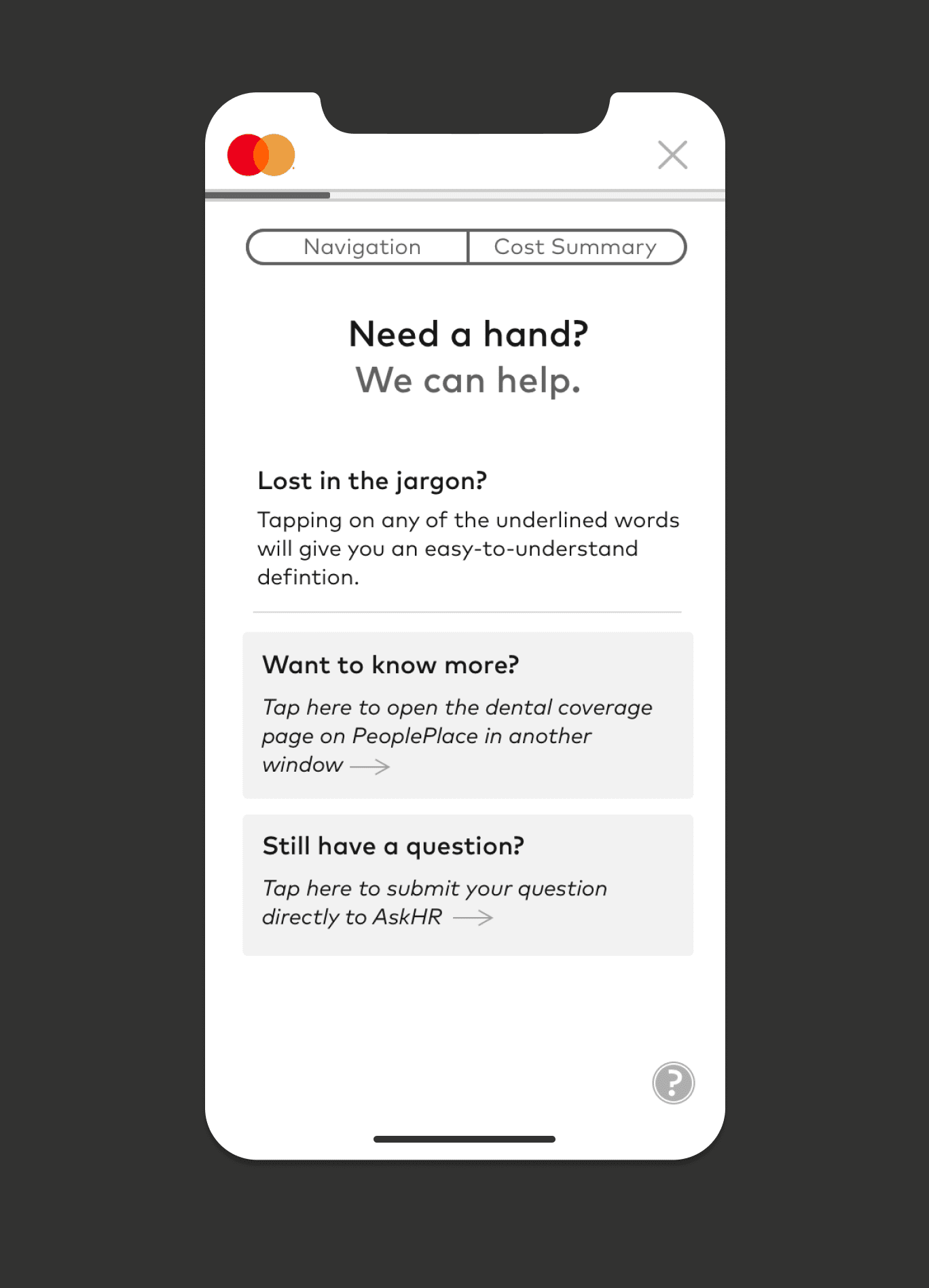

- Easy Access to Help - all screens in the desktop and mobile versions include an easy to access help button that directs users to the appropriate resources

- Keyword Definitions - a new feature that supplies definitions for common technical terms on mouse-over

- Mobile Expansion - all users can now conveniently access Choose Well both from a desktop computer and on the go

FURTHER STEPS

After completing the low-fidelity prototypes shown here, I was entrusted with another project with a more near-term deadline and handed off this project to some of my team members. While I would've loved to see my designs all the way through to development, I'm thrilled to say that the completed project is expected to launch globally in Spring 2022. Though this tool will undoubtedly improve the convenience of selecting benefits and lend confidence to

new employees, there are many more ways to improve upon Mastercard's insurance selection and enrollment experience, namely building the benefits selection tool directly into the enrollment process. While this step was not an option during my time on the project, it is in the long-term plan for the tool. I'm confident that the incredible Mastercard UX team will continue to improve upon the Choose Well design as they do so many other employee experiences.